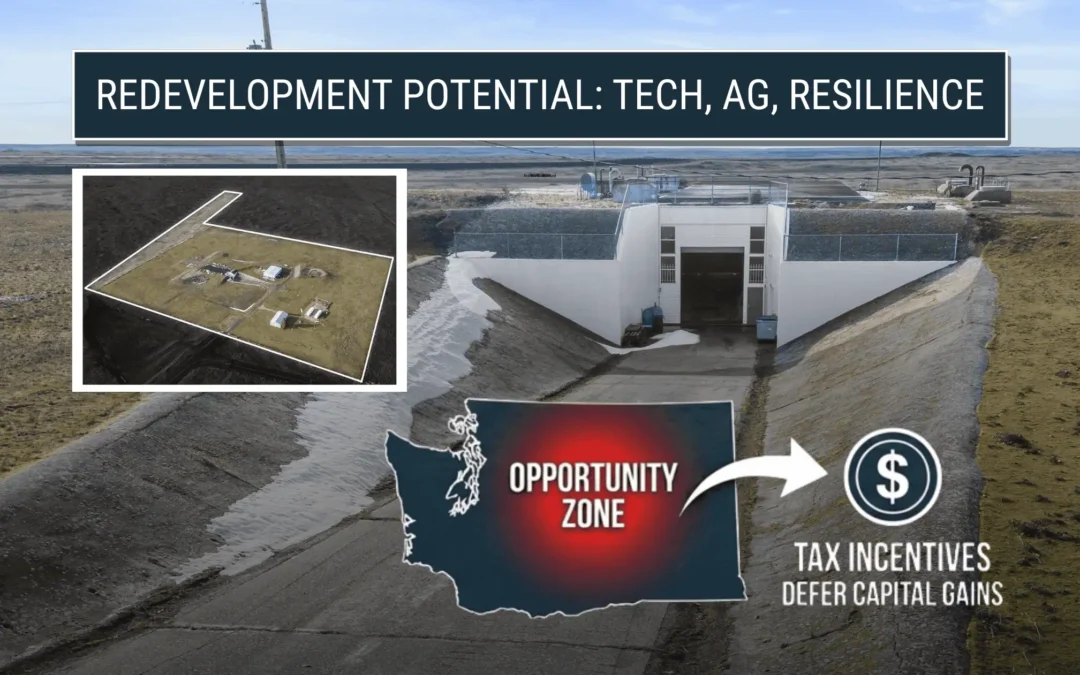

Why Investors Are Looking at the Washington Missile Base, One of Washington State’s Rarest Opportunity Zone Assets

A Cold War-era Atlas E missile base near Sprague, Washington is attracting attention from investors for a reason that goes far beyond its reinforced tunnels and underground space. It sits inside a federally designated Opportunity Zone. Only one census tract in Lincoln County qualifies, which makes this property one of the few rural Opportunity Zone sites in eastern Washington.

This combination of secure infrastructure and long-term tax incentives is creating interest from tech investors, developers, and buyers exploring adaptive reuse.

What Opportunity Zones Offer Investors

The Opportunity Zone program allows investors to reinvest eligible capital gains into a Qualified Opportunity Fund. When structured correctly, the investor may defer federal capital gains tax until they sell their Opportunity Fund investment or until December 31, 2026. They may also eliminate federal tax on appreciation if they hold the investment for at least ten years.

This applies to gains from the sale of stocks, real estate, businesses, or other assets. Investors have 180 days to roll gains into a Qualified Opportunity Fund that deploys capital in a designated census tract.

Confirmed Opportunity Zone Status for the Missile Base

The Washington Missile Base is located in Census Tract 53043960400, the only designated Opportunity Zone in Lincoln County. This can be verified through the CDFI Fund and national OZ mapping tools.

What Sets This Property Apart

Most Opportunity Zone properties require extensive preparation before investment funds can deploy. The missile base offers an unusual head start.

The site includes over 15,000 square feet of secure, dry underground chambers, reinforced tunnels, steel blast doors, and a move-in-ready three-bedroom home on 24.5 acres. It also has power access, cleared land, and proximity to I-90.

Because Opportunity Zone rules allow substantial improvement or original use pathways, buyers have flexibility in how they structure redevelopment.

Possible Qualified Opportunity Zone Uses for the Missile Base

Technology and research uses fit the layout, including robotics testing, advanced materials labs, and secure server facilities.

Controlled-environment agriculture suits hydroponic farming and plant research with stable underground temperatures.

Light manufacturing aligns well with fabrication, clean-tech assembly, or prototyping.

Film and media producers may use the site as a ready-made set.

Resilience-focused businesses, including preparedness training or off-grid system development, fit the infrastructure.

Rural Opportunity Zone Benefits

Federal updates have highlighted rural tracts for improvement incentives. Discussions in 2025 suggested extensions or ehancements, though investors should confirm all current rules with a tax professional.

Lincoln County’s Opportunity Zone blends rural incentives with access to Spokane’s tech corridor.

State-Level Considerations for Washington Investors

Washington has its own capital gains tax. For 2025, the rate is 7 percent up to one million in gains and 9.9 percent above that. This tax is separate from federal Opportunity Zone rules.

What Investors Should Evaluate

Before relying on Opportunity Zone incentives, buyers should confirm the property location, qualification for original use or substantial improvement, the timeline of improvements, and Qualified Opportunity Fund compliance. Professional tax guidance is essential.

A Rare Blend of History, Security, and Long-Term Incentives

The Washington Missile Base offers a secure, adaptable facility inside one of Washington’s rare Opportunity Zones. Investors seeking long-term value, tax deferral, and redevelopment potential will find this property stands out.

Disclaimer

Information about Opportunity Zones is provided for general awareness only. Washington Missile Base and its representatives do not provide tax, legal, or financial advice. Investors should consult qualified advisors to confirm eligibility and compliance under current IRS rules.